About Us

The Centre for Financial Capability

Formed in 2021, the Centre for Financial Capability was launched with the mission of ensuring every child in the UK has the opportunity to develop the skills and behaviours necessary to navigate critical financial decisions in later life, starting at primary school. Inspired by ground-breaking research by the Money and Pensions Service which found money habits form around the age of 7, the Centre for Financial Capability brings together key stakeholders across the primary financial education space to achieve the shared aim of ensuring all children receive a high-quality and effective financial education starting at a primary level.

At the Centre for Financial Capability, we believe that we need to start financial education as early as possible, and we have four aims including investment in financial education delivery, championing innovation, building evidence of what works and campaigning for greater investment into this important area. We work with Government, civil servants, charities and businesses to improve access and quality of financial education.

Investing in financial education delivery

We are proud to deliver award-winning financial education lessons to primary aged children via the Kickstart Money programme funding MyBnk expert-led financial education lessons, reaching a 100 schools and 3,000 young people with lessons on managing money in our first year.

Convening key stakeholders and campaigning for policy change

We are proud to supported by 15 firms, who all believe in the benefits of primary-aged financial education. The Centre has met with over 30 stakeholders, representing different organisations, charities and stakeholders based in the UK and internationally.

TCFC has also been campaigning Government for greater investment into primary school financial education. The Centre has also held many meetings with Government departments and cross-party MPs and Ministers, establishing a positive support base and has resulted in TCFC’s messaging into financial education for primary aged children gathering public and parliamentarian support. The Centre, and the KickStart Money programme, have over 50 cross-party supporters in parliament.

As a collective forum for stakeholders, TCFC has been convening key organisations, charities, business leaders, MPs and civil servants, to discuss the merits and ways of financing primary financial education via the Dormant Assets Scheme, and presenting these ideas to Government.

Pioneering research and innovation

We are working to promote further innovation and evaluation in primary financial education to provide a variety of delivery models. In 2022, TCFC played a key role in helping to facilitate the launch of the UK’s first multi-year study into the effectiveness of financial education, in partnership with RedStart, a leading financial education charity, and Kings College London.

Our Policy Asks

National curriculum

All primary children to receive a high-quality and effective financial education of some form by at least 2030.

Build financial education into the national curriculum at primary aged level with assessment, following the Bikeability model.

Continuous support for teachers

Give teachers access to resources and support they’ll need to deliver financial education, such as tools and resources, CPD opportunities and in-school mentoring support.

School inspection frameworks and assessment

Financial education to be included in the school inspection framework to encourage its delivery, based on a robust and consistent definition of “high quality” and “effective”, including considering how children’s capability can be assessed through Outcomes and Evaluation Frameworks, Educational Assessments or OFSTED.

Ways to fund financial education

Use unclaimed assets set to be unlocked from the saving and investment sector to fund organisations with specific aims of promoting and funding the development and delivery of financial education in primary aged children.

Continued expansion of contributions and donations from financial services.

KickStart Money Initiative

The predecessor to the Centre for Financial Capability, KickStart Money is a coalition of 19 savings and investment firms with a vision to ensure every primary aged child receives a high-quality and effective financial education. The coalition was brought together in 2017 in response to ground-breaking research by the Money and Pensions Service that found attitudes towards money and financial habits are formed as early as 7. KickStart Money contributed over £1 million to fund the delivery of financial education to almost 20,000 primary school children, delivered by the charity MyBnk. The coalition also a funded three year-long evaluations of this programme that prove the benefits of financial education at a primary level. 2 out of 3 primary aged children who received KickStart Money funded financial education were working towards a savings goal after receiving lessons. This is nearly double the national average.

The KickStart Money Programme

The Kickstart Money programme is a financial education programme designed to help set positive money habits and mindsets from an early age. Expert My Bnk trainers deliver live and secure lessons to your school as pupils complete activities in class. This is combined with teacher resources and family challenges. All materials are sent in advance.

The programme consists of an assembly and three sessions led by expert trainers and complemented by resources for teachers and carers. Case studies, games, videos and popular culture are all used to encourage students to explore and form their own opinions on money and their relationship with it.

There are three workshops, differentiated for Lower KS2 (7-8 year olds) and Upper KS2 (9-11 year olds):

Virtual KickStart Money

In response to the national ‘lockdown’ brought about by COVID-19, KickStart Money funded the development of free online financial education provision for children aged 5-11, delivered by My Bnk. The Virtual KickStart Money programme consists of live sessions delivered by secure video-link to provide KickStart Money funded sessions in schools unable to host physical sessions.

The virtual programme still involves writing, drawing, maths and problem-solving, as resources are sent in-advance. Videos and manga comics are used to engage students so they can remember new knowledge and form their own opinions.

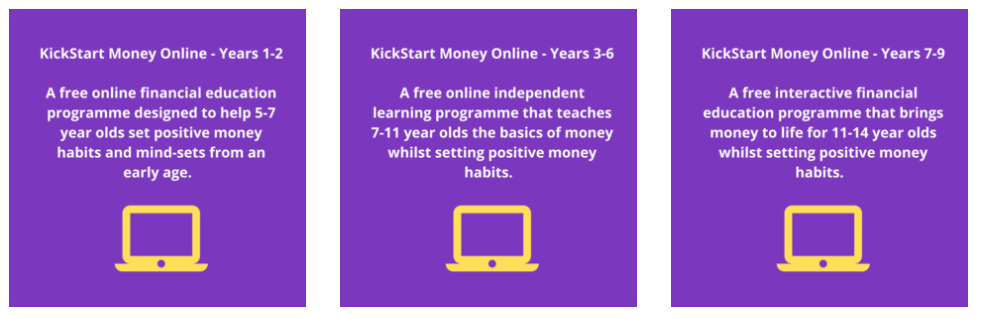

KickStart Money Online

KickStart Money also funds a free online financial education programme delivered by My Bnk, which can be completed at home by children aged 5-7, with the support of a guardian, and aged 7-11 independently. These home-learning sessions have been designed to complement our primary school programmes by offering to bring money to life and begin a child’s financial education journey.

KickStart Online is designed to improve childrens’ understanding of the value of money and delayed gratification by making spending and saving decisions and gaining rewards, by tackling often difficult topics such as income and the household finances. Sessions cover key issues of where money comes from, everyday costs, needs and wants, tracking spending and saving.

There are three online programmes, differentiated by key primary age groups: